Mariana have launched an Income Plan (There are very few quality plans available to investors who require ”Income”)

Take a look at the plans shape:

https://www.bestpricefs.co.uk/structured-products/ftse-defensive-income-kick-out-plan/

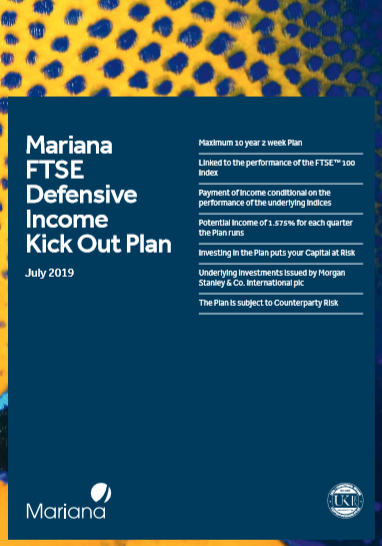

Mariana FTSE Defensive Income Kick Out Plan – July 2019

This is a ten year plan based on the performance of the FTSE™ 100 Index, the underlying. The plan is constructed to offer a potential income of 1.575% per quarter providing the closing price of the underlying is at or above 75% of the start level on a quarterly observation date. If the closing price of the underlying is below 75% of the start level on a quarterly observation date, no income is paid for that quarter and the income for that period is permanently lost.

Investors will only receive the quarterly potential income if the income criteria is fulfilled on a quarterly observation date. To note, if, on every one of the quarterly observation dates the income criteria is not fulfilled, investors will receive no potential income throughout the term of the plan.

The plan has the possibility to kick out from the end of year 2 and quarterly thereafter. Should the closing price of the underlying be at or above 105% of the start level on any one of the kick out observation dates, the plan will mature early paying the potential income for that quarter and returning initial capital in full (subject to counterparty risk).

If the plan has not already kicked out, initial capital will be returned in full at the end of the plan’s term if on the maturity date (19 July 2029) the finish level of the underlying is not more than 35% below the start level.

Risks

Investors are at risk of losing your capital if the closing price of the underlying is less than 65% of the start level (representing a decline of more than 35% from the start level), investors initial capital will be lost at a rate of 1% for every 1% the closing price of the underlying is below the start level.

Please read our ”Don’t forget the risks” section- which explains the general risk involved when investing in structured capital at risk products.

https://www.bestpricefs.co.uk/structured-products/ftse-defensive-income-kick-out-plan/#risks

The counterparty chosen for this plan is Morgan Stanley & Co. International plc. Morgan Stanley & Co. International plc, an affiliate of Morgan Stanley, is the issuer of the underlying investments that are purchased on your behalf with the money you have invested.

Morgan Stanley & Co. International plc and its subsidiary undertakings are part of a group whose principal activity is the provision of financial services to corporations, governments and financial institutions. Morgan Stanley & Co. International plc is authorised by the Prudential Regulation Authority (“PRA”) and regulated by the PRA and the United Kingdom Financial Conduct Authority. More information on Morgan Stanley & Co. International plc can be found on their website www.morganstanley.com .

You may lose part and up to all your investment if Morgan Stanley & Co. International plc goes into liquidation and defaults on paying your plan return and the repayment of your initial capital.

Product Promotion

The promotion of this and any other product does not represent ”advice”. Financial advice is provided once the full needs of the investor has been generated in a regulatory format; known as the ”know your customer” journey- where a suitability recommendation can be subsequently provided

This income product requires ”advice” – so if you are interested in investing in the above plan – Simply get in touch, in order that advice can be provided.

Warmest regards

Best PriceFS Team