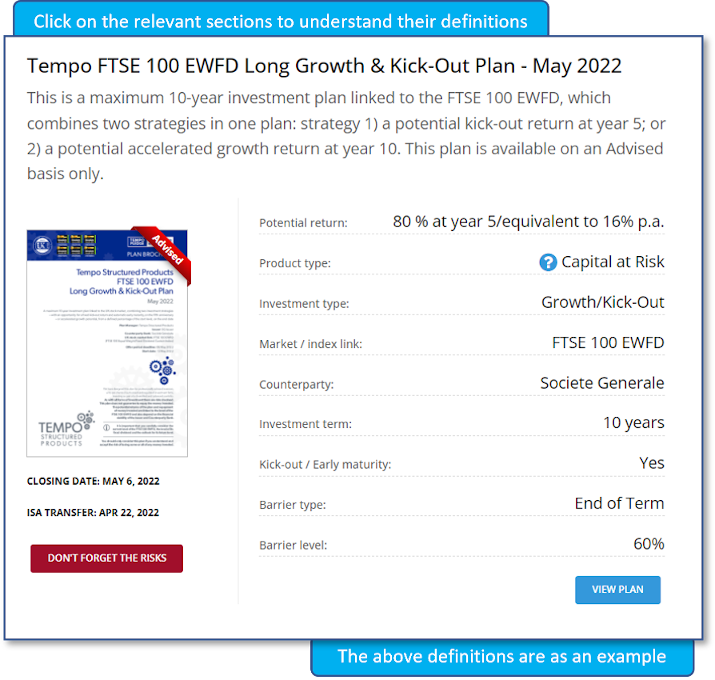

Walker Crips UK & US Annual Kick-out Plan (MS230)

The Walker Crips UK & US Annual Kick-out Plan (MS230) is a six year investment offering a Potential return of 10.25% per annum, dependent on the performance of the Index.

- Potential return: 10.25 % per annum, dependent on the performance of the Index

- Product type: Capital at Risk

- Investment type: Growth/Kick-Out

- Market / index link: FTSE 100 Index and S&P 500 Index

- Counterparty: Morgan Stanley

- Investment term: 6 years

- Kick-out / Early maturity: Yes

- Barrier type: End of Term

- Barrier level: 65%